This Odd Trade Could Double in 72 Hours

This is ODD!

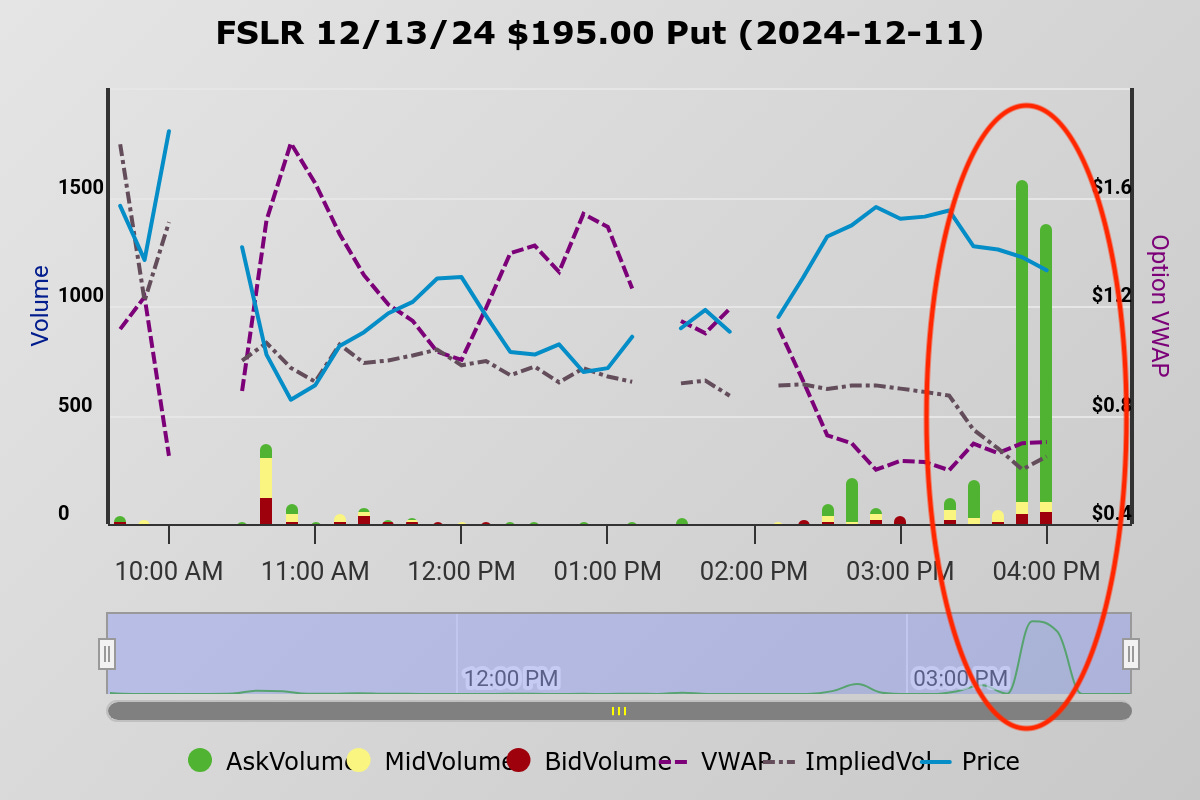

With just 10 minutes to the closing bell today, something unusual happened.

Among the 51 million option contracts traded across the market, a flurry of activity on First Solar (FSLR) stole the spotlight.

Nearly 3,000 contracts of the $195 puts—bets that the stock will drop—were bought at the offer price. By the time the dust settled, a total of 4,500 contracts had traded on this strike.

Here’s why this is odd:

These options expire in just 48 hours. This isn’t a long-term bet—it’s all or nothing.

They paid at the offer price, showing urgency.

The total risk? A whopping $315,000.

This wasn’t your average trade. It was precise, aggressive, and driven by something we don’t yet see.

And when a trade like this pops up, you have to ask: Why are they betting so heavily that First Solar will drop—and fast?

Let’s connect the dots.

First Solar has been a leader in the renewable energy boom. But after the U.S. election, stocks like FSLR have faced pressure. Fears of a policy shift—including expanded fossil fuel production and rollbacks on renewables—have cast a shadow over the sector.

Here’s what could be driving this:

Short-term uncertainty. The president-elect has signaled intentions to scale back offshore wind projects and increase drilling on federal lands. These moves could shake confidence in renewable energy stocks.

A technical sell-off. FSLR’s chart shows signs it’s teetering on key support levels. If those break, the stock could tumble further.

So, what does this mean for the trade?

The $195 puts signal that Smart Money is betting on a short-term move lower. But let me be clear: This is a bold, high-risk trade.

Here’s something I’ve learned in my 20 years of trading: Call activity is easier to read.

Institutions buy calls because they expect prices to rise—it’s straightforward.

But when it comes to puts, things get more nuanced. Traders might buy them to hedge, protect a portfolio, or take a direct bearish position.

And trying to short a strong bull market—like renewable energy—can be brutal. It’s where money often goes to die.

That’s why, as much as this trade intrigues me, it’s one I’ll watch from the sidelines.

But it’s trades like these that highlight why we track Smart Money so closely.

Here’s the real value of understanding Smart Money moves: Most traders don’t even know trades like this are happening. But with Hot Money Trader, you’re never left in the dark.

We track institutional activity in real time, helping you uncover the most important trades—and showing you how to act on them with confidence.

When you join, you’ll get:

156 Exclusive Trade Alerts Per Year: Three actionable ideas every week, all based on Smart Money signals.

Step-by-Step Training: Learn exactly how to spot and interpret trades like the FSLR puts.

Live Trading Session (Monday, Dec. 16): Join us as we break down the top trades of the day and walk you through how to execute them.

This isn’t about chasing every wild move—it’s about trading smarter.

👉 Reply “VIP” now, and I’ll send you all the details to join our next live session.

Don’t let another trade like this pass you by.

Trade Smart,

Josh Belanger