Hey there,

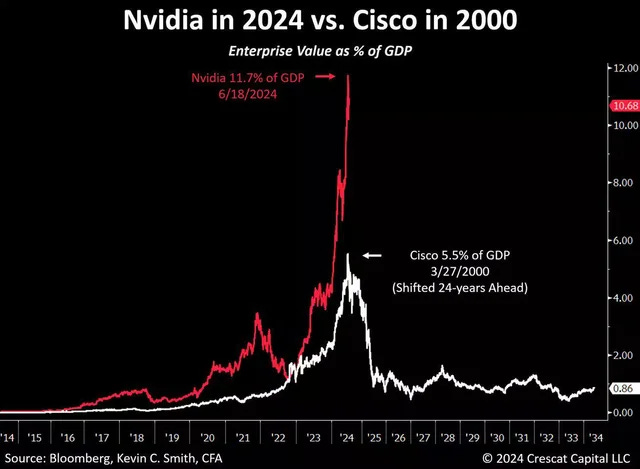

There’s a chart going around that’s getting a lot of attention.

It’s comparing Nvidia (NVDA) today with Cisco at the height of the Dot-Com bubble. And, yeah, it’s shocking at first glance:

Nvidia is now worth 11.7% of the entire US GDP, while at its peak, Cisco was worth just 5.5% of US GDP.

At face value, that sounds like Nvidia is double the bubble Cisco was. But hold on a second… it’s important to understand that we’re comparing apples to oranges.

Here’s why this comparison is way off:

1. The Market Is Very Different Now

The US stock market has lost half of its publicly traded companies since the 1990s. That means we have far fewer companies today, and the ones that remain—like Nvidia—are more concentrated, leading to these higher valuations.

2. Inflation Makes Money Worth Less

The buying power of the dollar today isn’t what it was in 2000. Inflation means you need more dollars today to buy the same things you could buy back then. So when you look at Nvidia’s market cap, remember that it’s inflated by today’s weaker dollar.

3. Compare Valuation, Not Just Market Cap

Here’s where things get really interesting—if you want to compare Nvidia today with Cisco back in 2000, don’t look at market cap, look at valuation.

Nvidia’s forward P/E (2024) is 37x.

Cisco’s forward P/E in 2000? 105x.

That’s a huge difference!

Nvidia is actually far more reasonably valued than Cisco ever was at its peak. So while it’s tempting to compare market caps, you have to dig deeper and look at the numbers that matter.

The Trade Opportunity

Right now, Nvidia is trading at $135—the same level it hit back in June, before reaching an all-time high and then pulling back. It’s recovered, and now it’s just 3% away from breaking through to fresh highs.

Back in September, I sent out a trade alert on Nvidia, and it landed right in your inbox.

That trade ended up being a 75% winner in just 9 days.

But… you didn’t act on it. You missed it. Maybe you passed on it. And that’s fine—it happens.

But here’s the kicker: you could’ve re-entered that same trade two more times for additional profits. Others did, and they cashed in—again and again.

But you didn’t.

Now, Nvidia is trading at $135, just 3% away from breaking into fresh highs. And I’ve got another big move lined up.

This is your shot at redemption. Don’t let the next one slip through your fingers.

If you’re ready to take advantage of Nvidia’s next big move, join me inside Belanger Trading Advisory. I’ll send you the exact trade setup and show you how to play Nvidia again.

Click here to join and get the next NVDA trade.

The markets may be different, but the opportunities are still huge.

Trade smart,

Josh Belanger

Do you think the money that was invested in generative AI will pay off in the near future? I’m starting to see that Wall Street investors are getting antsy because they aren’t seeing the returns they thought they would with AI. Does that indicate that a bearish market is looking behind all this AI praise?